Back in October, Quebec put taxpayers on the hook for a $1 billion bailout of planemaker Bombardier (which was having one hell of a hard time creating a buzz around its CSeries commercial jet program).

Bombardier has been around for nearly 8 decades and employs more than 40,000 people in the province. The company’s role in the provincial economy is “incalculable,” Quebec’s Economy Minister Jacques Daoust said last year. “How can I let them go?” he asked.

For its money, Quebec would get a 49.5% stake in a new business that will own the assets and liabilities of the CSeries commercial jet program (which isn’t exactly going well). In exchange, the company promised to manufacture the aircraft in the province for at least 20 years.

“How confident is Quebec that this will fan out for the economy and taxpayers? That’s what we don’t know,” Paul Boothe, a former senior Canadian official

…who was the federal government’s lead negotiator with the domestic units of GM during bailout talks in 2009 said at the time.

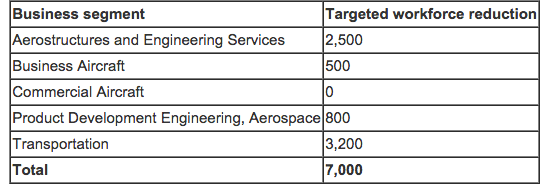

Well, now we do know. On Wednesday, Bombardier announced it’s cutting 7,000 jobs as part of a “global workforce optimization.”

“Impacted positions are mostly based in Canada and Europe,” the company said this morning, after reporting results that missed estimates on both the top and bottom line. Here’s the breakdown:

So obviously that sounds bad, but don’t worry because the job losses will be “partially offset” by hiring in “certain growth areas.” Like the CSeries program. Which is “growing” so fast that the company had to take a $1 billion bailout from the provincial government to shore it up.

“Production rates for some models have been modified,” Bombardier goes on to say, in an attempt to explain the layoffs, “due to macroeconomic conditions.“ For those who don’t read a lot of quarterly reports, that’s a polite way of saying this: “demand is really, really soft.”

The company says the CSeries program has “generated new jobs at the Bombardier facility in Mirabel, Québec,” although the number of new jobs isn’t specified nor does the company indicate what the net job creation (or, more likely, “job destruction”) will be in Canada after the “optimization” is implemented.

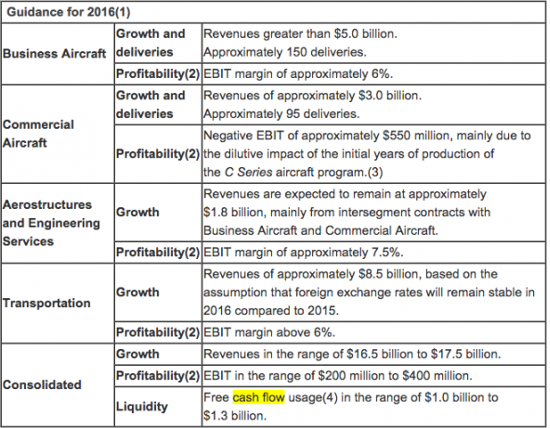

As for the company’s 2016 outlook, revenue guidance looks well short of estimates at $16.5-17.5 billion (consensus was $18.2 billion), while FCF usage is generally in line at between $1 billion to $1.3 billion, although if it comes in at the high end, that will be close to the highest analyst estimate. The company burned $1.82 billion in 2015. Here’s the full guidance breakdown:

On the bright side, Bombardier and Air Canada announced today that they’ve signed a Letter of Intent for the sale and purchase of 45 CS300 aircraft with options for an additional 30 CS300 aircraft, including conversion rights to the CS100 aircraft.

Oh, and the company is going to try a reverse split to make it seem like its shares aren’t worthless.

So there you go Canada, Bombardier thanks you for the $1 billion you gave it. Any time you want to fork over some more money in exchange for thousands of layoffs, make sure to let the company know. They’ll be happy to oblige.